The Full Market Entry of New Energy

Advertisements

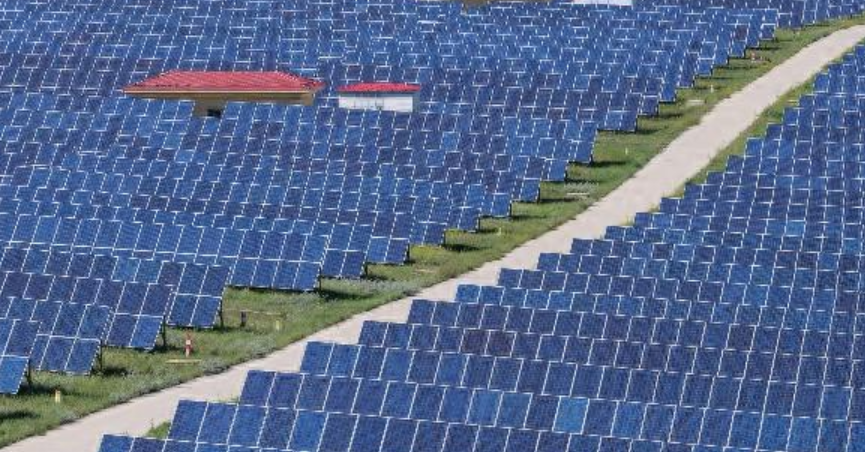

In the rapidly evolving landscape of renewable energy in China, a significant policy shift has emerged, signaling a departure from the previous guaranteed returns model to a market-driven approach. Investors and operators within the industry, such as the pseudonymous Du Bin, are keenly aware of this transition, recognizing that operational strategies for renewable energy facilities will now hinge critically on one’s ability to navigate the complexities of energy market dynamics.

This shift is anchored upon a notification released on February 9, 2025, designated as Document No. 136, which stipulates that renewable energy projects will largely transition to a market-based pricing system. Gone are the days of merely relying on quotas from state utilities to secure a steady stream of revenue. Instead, according to the new framework, the selling price of electricity generated from renewable sources will be determined by market transactions, a notable evolution from a system that previously assured minimum purchase prices.

The implications of this change are far-reaching. Industry analysts generally see Document No. 136 as the most pivotal step forward in China's broader efforts to reform its electricity market since the introduction of measures aiming to enhance market mechanisms in 2021. Under the former model, renewable energy installations benefitted from secure pricing and volume assurances, akin to a safety net. However, as Du Bin articulated, the key challenge ahead lies in developing new strategies that adapt to this emerging “no guarantee on quantity or price” environment.

Many industry participants, including Du Bin, were not surprised by the policy direction, as there had been indicators earlier in 2024 suggesting a trend towards decentralizing market entry for renewable sources across provinces such as Shandong. Yet, while the transition was anticipated, the real test will be how stakeholders recalibrate their investment strategies to optimize returns in a fully competitive market landscape.

One of the most pressing concerns that investors harbor is related to the risks of consumption and the uncertainties surrounding electricity pricing. The intersection of these two variables—quantity and price—has a direct impact on project profitability, thereby influencing the willingness of companies to scale their investments in renewable energy. Reports have already indicated a significant decline in prices for photovoltaic (PV) and wind power generation across various provinces, such as Gansu, where capture prices for PV and wind decreased by approximately 37% and nearly 16%, respectively, from the previous year.

The challenge, then, lies in the architecture of market mechanisms that not only secures adequate returns for renewable energy projects but also accurately reflects real-time market prices. Document No. 136 introduces an innovative approach by proposing the establishment of a sustainable pricing adjustment mechanism for renewable energy. This mechanism allows for price equalization outside the market—where any difference between the market transaction price and a predetermined mechanism price is compensated by grid companies. This could provide some financial cushion for renewable projects, albeit the effectiveness of this measure hinges on how it is implemented at provincial levels.

Peng Peng, Secretary-General of the China Renewable Energy Investment and Financing Alliance, succinctly described how these mechanisms will function with a framework of “price contracts, surplus refunding, and market fluctuations.” By establishing benchmark pricing frameworks, the expectation is that firms can stabilize earnings against the backdrop of varied market prices. This marks a stark departure from legacy fixed price agreements, as it incorporates a more dynamic response to market economics.

However, it must be noted that this new system, while promising, comes with caveats. It is crucial to consider the varying cost structures of existing and new projects, as older installations may still receive different compensation based on their established price points, potentially leading to inequities in how market risks are shared across the board.

Research from the Guojin Securities team highlights that the nuances of these new frameworks are heavily influenced by regional attitudes, suggesting that areas with abundant renewable resources, especially in eastern provinces, will continue to invest heavily in renewable energy while potentially enjoying higher returns.

Moreover, implications extend beyond just the electricity generation sector. With this policy shift, the landscape for energy storage—an essential component of modern renewable energy systems—faced a significant change. Document No. 136 notably states that energy storage systems will not be a prerequisite for new renewable project approvals, which could mean a reduced emphasis on previously mandated storage requirements. Yet, how this impacts existing projects that have already incorporated storage solutions remains to be seen.

Historically, regions like Xi’an have imposed strict storage ratios, with research indicating that storage demand has been a major driver for new installations. For instance, investing in storage typically raises initial project costs by 8-10% for solar and even more—15-20%—for wind. The consequence of these enforced configurations often led to misaligned incentives, with operators utilizing storage only to meet regulatory requirements rather than optimizing performance or profitability.

The recent policy directive raises questions about whether this decoupling from storage requirements will ease competitive pressure on storage pricing and market adoption. Lin Boqiang of Xiamen University emphasized that while immediate demands based on mandatory configurations might diminish, the long-term potential for market-driven energy storage solutions remains strong, potentially leading to profitable innovations in this space.

Overall, the release of Document No. 136 not only reshapes the expected earnings for renewable energy projects but also raises pertinent questions about the competitiveness and viability of existing and future installations. Investors and operators alike must now recalibrate their strategies to align with these new realities, balancing operational efficiencies with market-based pricing mechanisms.

As the renewable energy landscape in China continues to evolve, stakeholders will undoubtedly need to adapt swiftly, leveraging new market opportunities while also collaborating on strategies that ensure the long-term sustainability of China's energy transition. Nuanced market designs, robust investor engagement, and supportive regulatory frameworks will play critical roles in navigating these changes, emphasizing the importance of strategic foresight in an increasingly dynamic and competitive energy environment.

DeepSeek's IPO: Can It Replicate Alibaba's Success?

Chinese Investors Pour Billions into Gold ETF

Japan's Trade Surplus Hits Record High

SoftBank's Q3 Loss Exceeds Expectations

Analysis of the U.S. Stock Market

U.S. CPI Surprises on the Upside

Core CPI Accelerates to 0.4%

Diverse Trends in DeepSeek Concept Stocks

Currency ETF Surge: What's Behind the Rally?

Apple Teams with Alibaba, Samsung with Zhipu